Exploring Contango: A Futures Protocol Free from Funding Rates

Written on

Chapter 1: Introduction to Contango

Imagine a world where you can trade futures without the hassle of funding rates. These rates often complicate the maintenance of open positions over the medium to long term in derivatives trading. If you're curious about how this can be achieved, continue reading as we delve into Contango, an innovative protocol that facilitates futures trading with fixed rates—effectively eliminating funding rates.

Section 1.1: What is Contango?

Contango is a decentralized exchange designed to provide expirable futures without relying on an order book or liquidity pool. It stands out as the first platform to offer futures that expire using fixed interest rate protocols. Expirable futures serve as a derivative tool, allowing parties to agree on trading an asset at a predetermined price and date in the future. This concept is relatively new within the DeFi landscape. Before diving deeper into the protocol, let’s briefly explore the different types of futures available.

Section 1.2: Understanding Futures Types

Perpetual Futures: Currently, perpetual futures are the most popular derivatives in DeFi, with platforms like GMX and Gains Network leading the way. Their simplicity and ease of understanding have significantly contributed to their growth in the DeFi sector.

Expirable Futures: In contrast, expirable futures come with a defined expiration date for contract redemption. These futures have their own pricing, which can differ from the underlying asset's value. Notably, expirable futures do not entail funding rates, as all costs are predetermined. Consequently, these derivatives may be more advantageous for long-term strategies, whereas perpetual futures are typically preferred for short-term trades.

Section 1.3: Use Cases for Contango

Contango highlights several key use cases:

- Speculation: Financial derivatives are primarily used to speculate on asset prices. Given current macroeconomic conditions, you might foresee a decline in BTC prices over the medium term, making expirable futures a viable option for shorting BTC.

- Hedging: This method protects against potential losses without incurring funding rates. By taking a long position on an asset while simultaneously going short for the same duration, you can maintain a delta-neutral stance, avoiding losses or gains while still earning returns on the open trade.

- Arbitrage: Arbitrage involves capitalizing on price discrepancies between different markets. With its unique pricing structure, Contango creates opportunities for traders to buy low in one market and sell high in another, facilitating profitable transactions.

The first video, "Contango: A New Approach To Perps Built On Money Markets," discusses how this protocol introduces innovative strategies for trading futures, enhancing the landscape of derivatives in crypto.

Section 1.4: The Absence of Funding Rates

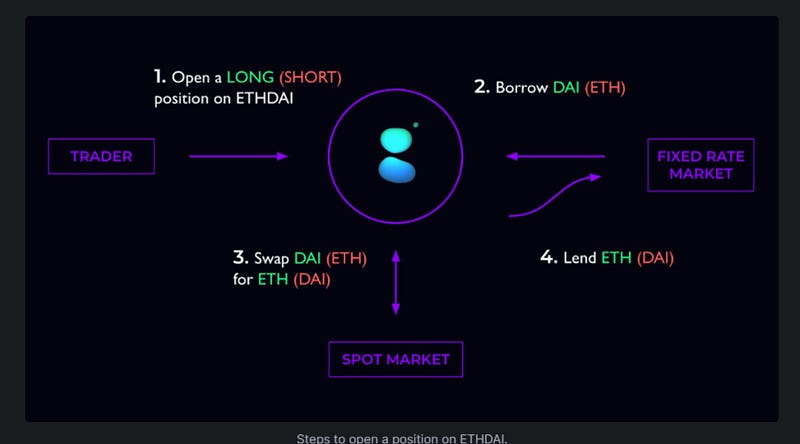

Contango operates on @yield and @NotionalFinance's fixed-rate loan markets, enabling it to function without an order book or liquidity pools. For instance, if you wanted to open a futures position with 5x leverage on ETH/DAI, you would borrow DAI, convert it to ETH in the spot market, and subsequently lend the ETH. This process establishes a long position, with fees limited to the difference between the DAI and ETH loans.

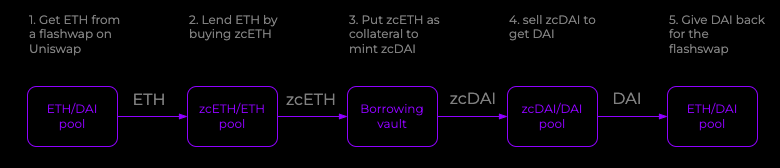

Section 1.5: Leveraging with Contango

To facilitate leverage, Contango employs Flash Swaps, allowing users to acquire tokens before settling payment. This mechanism involves purchasing an "X" token at the start of a block and paying for it with a "Y" token at the block's conclusion.

Section 1.6: Tokenomics

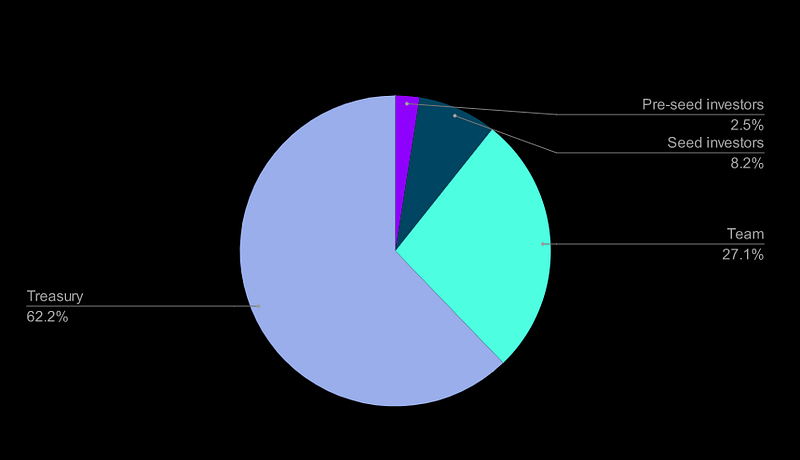

Currently, Contango does not possess a token but plans to introduce one in the near future.

In conclusion, Contango empowers users to engage with expiring futures, granting the flexibility to maintain open positions for extended periods without the concern of funding rates. This presents a compelling opportunity for speculators who have wished to utilize leverage in a long-term context but have been deterred by the costs associated with funding rates.

Chapter 2: Getting Started with Contango

The second video, "How To Navigate The Solana Ecosystem | Get Started With SOL & Wallet Set-Up," provides insights on how to effectively utilize the Solana ecosystem, which may complement your experience with trading on platforms like Contango.

New to trading? Consider exploring crypto trading bots or engaging in copy trading to enhance your experience.