# You Don't Need to Be an Expert to Succeed in Cryptocurrency

Written on

Chapter 1: Embracing the Crypto Landscape

Have you ever heard those incredible stories of individuals who invested early in something and ended up with astonishing returns? You're about to encounter more of these tales, and more frequently than ever.

As a rough estimate, the digital asset market constitutes about 0.5% of the global money supply. If you consider the probabilities:

- There's a 50% chance it could diminish to zero.

- Conversely, a 50% chance it could rise to 1%.

Currently, we are at a neutral point. Anyone with a bit of common sense would argue that it's more likely for this percentage to grow over the long term. As we become increasingly immersed in digital experiences, it's reasonable to conclude that our valuation of digital assets will only increase.

Another perspective to consider is that for the first time, we have the opportunity to invest in something that could yield returns of 100 times or more. Such opportunities were once reserved for elite Silicon Valley venture capitalists. Thanks to decentralization and blockchain technology, everyday individuals can now participate.

You don't need to be a genius to grasp the fundamentals of supply and demand, but applying timeless investment principles is essential. It's also beneficial to maintain a bit of common sense.

Let’s explore some crucial advice on what to avoid when investing in cryptocurrency.

> What Not To Do:

> - Don't invest more than you can afford to lose.

> - Avoid emotional trading.

> - Don't follow the hype blindly.

> - Refrain from chasing quick profits.

All of these pitfalls are tied to emotional decision-making. The cryptocurrency market can be volatile, and if your funds are tied up in assets you can't afford to lose, it can lead to anxiety, especially when prices fluctuate dramatically.

Here’s how to mitigate that anxiety: Dollar Cost Averaging (DCA).

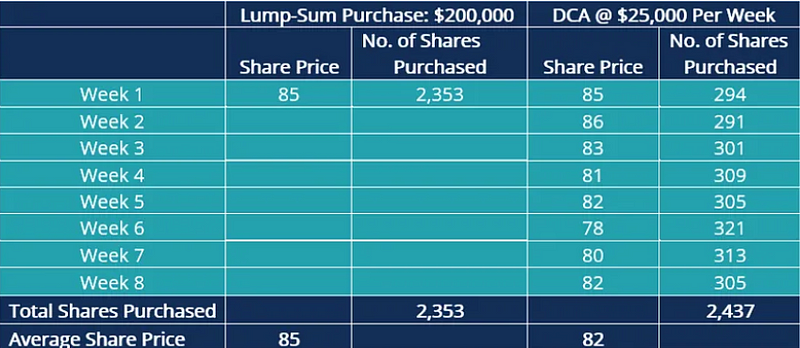

DCA is a technique where you invest a fixed sum of money at regular intervals, irrespective of the market price. This strategy helps reduce volatility’s impact and can lead to steadier long-term gains while minimizing emotional involvement.

Surprisingly, data indicates that DCA may not always yield better returns than a one-time lump sum investment, but it does offer several advantages:

- It diminishes risk through smaller transactions.

- It allows for purchasing when prices are lower.

- It helps you endure market downturns.

- It serves as a disciplined saving tool.

- It avoids poor timing.

The key benefit of DCA is that it enables you to acquire more assets during market dips. For instance, if you invested $200,000 as a lump sum, you would purchase 2,353 shares. However, with DCA, you could end up with 2,437 shares—84 more shares worth $6,888 at an average price of $82.

Chapter 2: The Case for Common Sense in Crypto

Here’s Why You Don’t Need to Be an Expert with Crypto to Win (Apply Common Sense)

With the rapid adoption of cryptocurrency, it's predicted that by the end of 2024, there will be around a billion users. The potential for widespread acceptance and explosive growth is akin to throwing a dart at a barn door; a child would likely hit the target.

Currently, more than 10% of global internet users—approximately 500 million individuals out of 5 billion—own some form of cryptocurrency. Data from Crypto.com indicates that this number has soared to 300 million, marking a 275% increase since January 2021. These figures reflect a rising global interest in digital currencies.

Despite a minor slowdown due to economic factors, cryptocurrency adoption continues to outpace the internet's peak growth rate. Projections suggest that by 2030, there could be around 4 billion cryptocurrency users, offering enormous potential for price appreciation.

Final Thoughts: Simplifying Your Investment Approach

Don't complicate your investment decisions. It's simpler than you might think to make the right choices.

While I haven’t specified which cryptocurrencies to invest in, if you insist, here’s my suggestion: allocate 50% to Bitcoin and 50% to Ethereum. Utilize DCA with whatever amount you can afford to lose, and try to forget about it.

If you were looking for a complex portfolio strategy or a finely crafted mathematical equation, I can't provide that. However, Bitcoin and Ethereum represent two of the leading blockchain networks globally. Bitcoin's value storage and Ethereum's network effects are unparalleled. Whether another blockchain will surpass them remains to be seen.

Conduct your research, remove emotional attachments, and understand that this isn't rocket science. You might just be pleasantly surprised by the results.

Join my Free Newsletter today and gain daily insights from top experts in crypto, business, finance, and technology.

This article serves informational purposes only and should not be construed as financial, tax, or legal advice. Consulting a financial professional before making significant financial decisions is recommended.

In this video, leading experts share everything you need to know about cryptocurrency, providing valuable insights into the world of digital assets.