Exploring the Value of Ethereum Classic (ETC) Post-Merge

Written on

Chapter 1: Understanding the Merge

In this section, we will examine the significance of the Ethereum Merge for both Ethereum (ETH) and Ethereum Classic (ETC), along with the broader cryptocurrency landscape.

“If Ethereum fails to scale, then Ethereum definitely failed.” — Vitalik Buterin.

The Merge aims to integrate ETH's tenth mainnet, known as "Shadow Fork," with the Beacon Chain, addressing the so-called "blockchain trilemma," which encompasses scalability, security, and decentralization to forge a robust, hybrid blockchain framework. This transition is poised to dramatically influence the cryptocurrency market.

Resolving this trilemma is a complex task, requiring extensive computing and testing over months or even years to guarantee a smooth and effective launch. For example, Ethereum’s transaction speed is projected to surge from 30 transactions per second (TSP) to an estimated 100,000 TSP.

It’s this trilemma that has given rise to nearly 20,000 altcoins within the crypto ecosystem, each attempting to tackle one or two aspects of the trilemma or offering unique features to enhance its token's value.

“Considering the end goal is reducing their carbon consumption by 99.85% — I’d say the effort was worth the time.” — Bitboy Crypto.

I appreciate Bitboy's candidness in his YouTube vlogs. He provides straightforward insights without excessive hype.

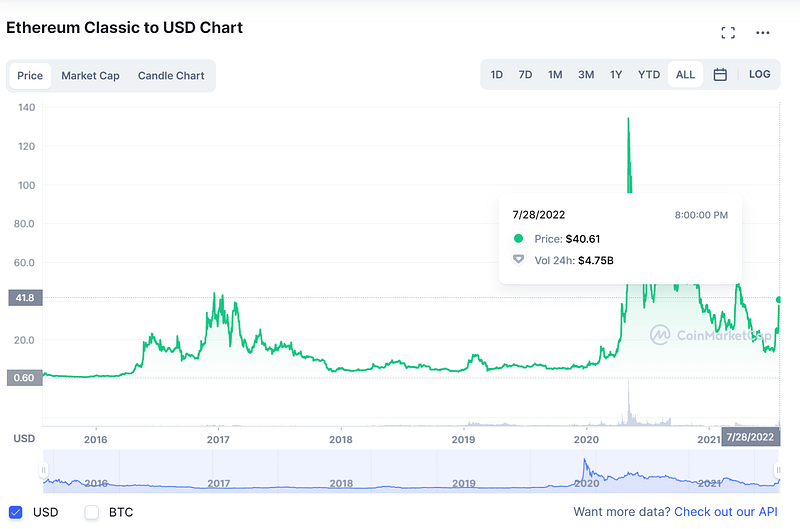

ETC emerged from the Ethereum fork in 2016 after a security breach in the Ethereum network. While the new ETH blockchain was developed to create a more secure environment, the original blockchain evolved into what we now know as ETC. The anticipation surrounding the Merge has recently propelled ETC’s price upward in the cryptocurrency market.

Chapter 2: The Benefits of Ethereum Classic

As it stands, ETC operates as a Proof-of-Work (PoW) altcoin, similar to the current ETH. What makes ETC particularly appealing now is its potential role in the aftermath of the Merge. With ETH transitioning to a Proof-of-Stake (PoS) model, many miners may look to switch to ETC, as the mining equipment remains compatible.

The conventional wisdom suggests that the energy consumption associated with cryptocurrency mining is detrimental to the environment. While this is partially true, one must consider the energy footprint of traditional banks, which often surpasses that of miners working on altcoins. In lieu of mining cryptocurrencies, these individuals might engage in Play-to-Earn (P2E) games, which also consume energy.

Description: A comprehensive review of Ethereum Classic (ETC) and its potential price movement towards $200 post-Merge.

When examining the banking infrastructure in a city of 10,000 residents, it’s common to find six or eight banks. Given the decline of check usage, why do we need so many banks? Recently, I learned that transferring $1,500 internationally could cost $50 at the bank.

In contrast, I can acquire $1,500 worth of USDT, BUSD, or BNB and transfer it to my wife's wallet, allowing her to convert it at little to no cost, with access to the funds within minutes. Traditional bank transfers can take hours or even days, particularly for smaller countries in Asia that often route through Hong Kong.

Cross-blockchain and cross-platform financial services are becoming available through various cryptocurrencies, frequently at a fraction of the cost charged by banks. For instance, PayID in Australia and comparable services in other nations facilitate quick and inexpensive money transfers. While first-time users may face a waiting period for ID verification, subsequent transactions are almost instantaneous.

ETC, derived from the ETH blockchain launched in early 2015, is a decentralized platform that supports smart contract applications, operating precisely as programmed to minimize the risk of fraud or third-party interference. Technically, ETC closely resembles ETH. Currently, ETH holds the #2 market capitalization position, while ETC ranks #16, boasting a market cap of $2.4 billion according to CoinMarketCap.

Description: Forbes critiques Ethereum Classic, labeling it "good for nothing" and presenting a price prediction for ETC that is a must-watch.

What is ETC? The native currency of the ETC platform is referred to as "Classic Ether" (ETC). This decentralized platform executes smart contracts without the possibility of fraud or third-party interference. ETC functions as a well-distributed computing platform that features smart contract (scripting) capabilities and offers a decentralized Turing-complete virtual machine known as the Ethereum Virtual Machine (EVM).

As ETH transitions to Ethereum WebAssembly (Ewasm), it's essential to understand the nuances of smart contracts.

“A smart contract is a self-executing digital agreement that allows two or more parties to exchange value transparently, without the need for a third party.” — Block Geeks.

I believe that comparing smart contracts to vending machines is a brilliant analogy, even if the phrasing could use some refinement. These executable scripts function across a global network of public nodes. ETC also provides a valuable token called Classic Ether, which can be exchanged between users, stored in cryptocurrency wallets, and used to compensate nodes for their computations.

Description: An animated explanation of Ethereum Classic (ETC) and how it operates.

Chapter 3: PoW vs. PoS

Understanding the distinction between Proof-of-Work (PoW) and Proof-of-Stake (PoS) consensus mechanisms is crucial. PoW is widely used by blockchains like Bitcoin and ETH. Each transaction on the blockchain is recorded in a ledger, allowing verification of its legitimacy.

Conversely, PoS is an emerging consensus mechanism favored for its potential to enhance transaction speed, scalability, and energy efficiency. PoW miners compete to solve intricate mathematical puzzles to validate transactions and add new blocks to the blockchain, while PoS relies on validators (owners) to confirm transactions and introduce new blocks.

The primary difference lies in the energy consumption and hardware requirements; PoW necessitates expensive equipment and significant energy use, whereas PoS is seen as a more sustainable and scalable alternative.

Description: An overview of the Proof of Work consensus mechanism and its implications for blockchain.

In PoS, block creators are chosen based on their stake in the network, meaning that participants with higher ETC holdings have better odds of being selected to validate transactions and generate new blocks.

Ethereum’s founder, Vitalik Buterin, reassured developers and users that ETC remains an option for those preferring PoW. This announcement has led to a noticeable rise in the coin's value, which is anticipated to continue as the Merge approaches, positioning ETC as a promising "buy and hold" investment.

While the future price of ETC post-Merge remains uncertain, the growing interest and investment in ETH could drive both cryptocurrencies' values up. If you’re contemplating an investment in ETC, now might be an advantageous time, as the Merge is expected to conclude in September 2022.

As of July 29, 2022, the live price of Ethereum Classic stands at $39.40 USD, with a 24-hour trading volume of approximately $5.47 billion. The current market cap is around $5.36 billion, with a circulating supply of 136,054,922 ETC coins out of a maximum supply of 210,700,000 ETC coins.

Chapter 4: Future Outlook for ETH and ETC

ETH and ETC are on an upward trajectory, especially with the anticipated Merge. In the past month, ETH has surged more than $700, moving from $1,000 to approximately $1,750. Meanwhile, ETC has more than doubled from around $15.00 to $44.00.

Many believe that there is still ample room for growth for both coins. However, some suggest that it might be wise to take profits. Ultimately, your investment decisions should align with your objectives and exit strategy, rather than being swayed by market hype or the opinions of others.

The cryptocurrency market is rife with fear, uncertainty, and doubt (FUD), and ETC and ETH have not escaped scrutiny due to their recent price increases leading up to the Merge.

“The secret to becoming wealthy on Wall Street is to be greedy when others are fearful and fearful when others are greedy.” — Warren Buffett.

Staking ETH could yield substantial returns on various exchanges, with some offering as much as 11% annual percentage yield (APY) in-kind (paid in ETH) and Binance offering 10% APY. Such rates are hard to come by at traditional banks.

#ETH #ETC #EthereumClassic #Ethereum #bitcoin #Cryptocurrency #fintech #cryptoinvesting #cryptocommunity

DISCLAIMER: This article is intended for informational and entertainment purposes only. It does not constitute financial or legal advice. Not all information may be accurate. I am not a financial advisor, and this content should be viewed as friendly discourse exploring potential investment opportunities. Please consult with a financial professional before making any significant financial decisions.