Understanding the Distinctions Among Marketplaces: Insights from a Founder

Written on

Recently, my company Pared featured in an essay by Andrew Chen and Li Jin titled "What’s Next for Marketplace Startups?" I've come across numerous insightful discussions about network effects from the brilliant folks at a16z, including pieces like "16 Ways to Measure Network Effects" and "The Dynamics of Network Effects." I appreciate the analysis of experts synthesizing themes relevant to businesses like mine. James Currier at NFX Guild impressively articulates this in his piece "The Next 10 Years Will Be About 'Market Networks,'" which resonates deeply with me. However, the challenge lies in condensing diverse business models into a single, cohesive narrative. The drawback of generalizing is that it often overlooks the nuances and critical success factors unique to each business or model. A focus on niche businesses may not attract as wide an audience for Andrew or James.

It's intriguing to observe how investors and academics analyze businesses like mine, yet insights from within are often scarce. No one understands the strengths and weaknesses of a network or marketplace better than the builders themselves. Engaging with fellow marketplace founders, such as my colleagues at Honor and Trusted, or executives from networks like LinkedIn, is incredibly enlightening. Although their experiences may not always directly apply, I invariably leave these discussions with new ideas that spark curiosity about my own business. Recent articles from the Andreessen Horowitz team, combined with these conversations, inspired me to share my insights on marketplaces.

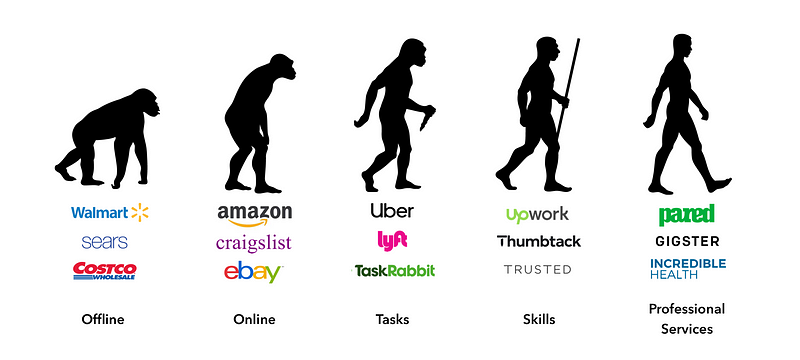

Through my journey with marketplaces like eBay, Luxe, and Pared, I've learned a fundamental truth: not all marketplaces are the same. Marketplaces have undergone significant transformations. While serving as the VP of Marketing at Luxe, an on-demand valet service, I played a role in launching six new markets for a two-sided marketplace involving valets and drivers. In my role as co-founder of Pared, a market network serving hospitality workers and operators, I've directed growth and marketing efforts from the outset. I've experienced firsthand the journey of building both a marketplace and a market network. Simplifying all marketplaces to mere supply and demand dynamics can be misleading. Marketplaces began as physical venues for buyers and sellers to engage (e.g., Wal-Mart, Costco, Sears). The internet then facilitated online platforms for transactions (e.g., Craigslist, eBay, Amazon). The advent of smartphones enabled individuals to earn money by performing discrete tasks (e.g., Uber, Lyft, TaskRabbit). Subsequently, more independent workers began monetizing their skills on various platforms (e.g., Upwork, Thumbtack, Trusted). Now, certified professionals are offering their services and networks through market networks (e.g., Pared, Atrium, Incredible Health). Each of these evolutionary phases represents a viable business model capable of thriving in today’s economy.

The development of marketplaces closely correlates with distribution strategies and addressing the information asymmetry between supply and demand, also known as lead generation. Technology and innovative business models have effectively created transparency in opportunities. The initial evolution transitioned from traditional brick-and-mortar transactions, bulletin boards, and classified ads to online exchanges for products and services. The second evolution focused on scalable distribution networks for routine tasks, such as laundry, grocery shopping, and ridesharing. The third evolution involved facilitating transactions traditionally mediated by agencies for skilled labor, like moving services, childcare, and administrative temp agencies. The final evolution seeks to replace the lead generation roles played by professional service brokers, such as law and nursing staffing firms, which often take substantial cuts from profits. Modern marketplaces are now eliminating middlemen, allowing suppliers to retain a larger share of earnings.

Having navigated various stages of marketplace evolution, I found it valuable to break them down. In this post, I will cover:

- The distinctions between two-sided marketplaces and market networks.

- How certain marketplaces gain more from network effects than others.

- The impact of different inventory types on marketplace defensibility.

- The significance of repeat transactions and reputation within marketplaces.

Marketplaces vs. Market Networks

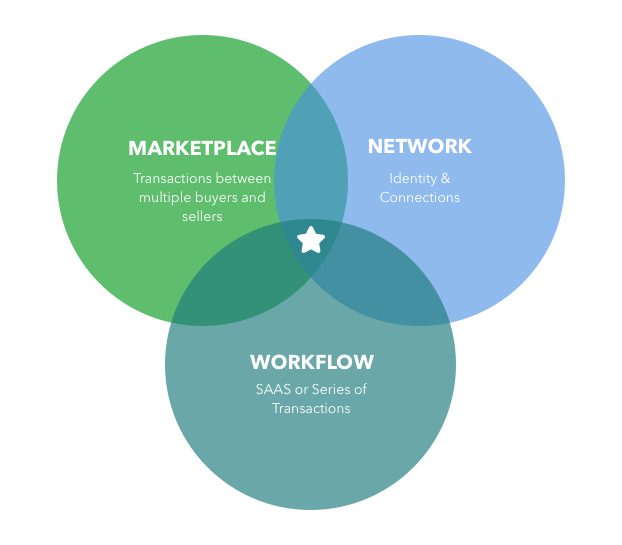

James Currier, co-founder and partner at NFX Guild, possesses extensive knowledge of marketplaces and networks. He serves as an investor or advisor to companies like Honeybook, Houzz, and AngelList, and he has founded multiple network and marketplace ventures. Currier introduced the term "market network" in a June 2015 TechCrunch article titled "From Social Networks to Market Networks." In his words:

"Marketplaces facilitate transactions among multiple buyers and sellers—like eBay, Etsy, Uber, and LendingClub."

"Networks provide profiles that showcase individuals' identities and enable them to communicate in a comprehensive manner with others in the network—think Facebook, Twitter, and LinkedIn."

"Market networks uniquely combine key elements of both networks and marketplaces."

Market networks leverage SaaS workflow software to emphasize long-term projects rather than quick transactions, allowing service providers to establish differentiated identities and foster long-term relationships. Currier articulates that market networks require SaaS software to prioritize sustained interactions over one-off transactions. I would argue that repeated interactions on a marketplace platform yield similar effects. For instance, with services like Handy or Wag, customers tend to prefer repeat engagements with trusted service providers, contrasting with one-off experiences typical of platforms like TaskRabbit or Uber.

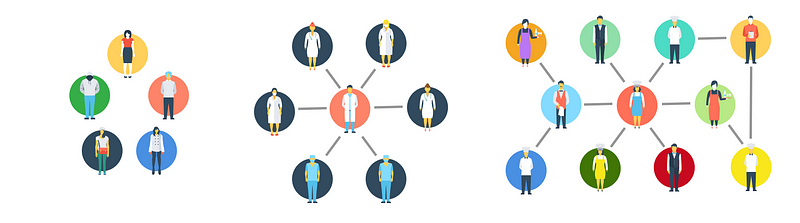

At Pared, for example, a restaurant may need a cook for several shifts each week. Various qualified cooks will be presented for those openings. It's crucial for the restaurant to cultivate a strong reputation as a desirable workplace; otherwise, cooks may hesitate to accept offers. Conversely, if a cook doesn't meet the expectations of enough restaurant operators, their reputation will suffer, limiting future opportunities. In a genuine market network, each participant should be able to provide meaningful feedback about others. All nodes within a market network can interconnect. Individuals working in the restaurant industry often have ties with others due to prior collaborations. Cooks may become restaurant owners, and sometimes chefs return to employment after their ventures do not pan out. We have observed numerous executive chefs who used Pared as customers eventually signing up to seek work and additional income through the platform. This fluidity enhances the strength of the market network, fostering greater interconnectivity among nodes. Some may even suggest we are constructing a LinkedIn-like platform for the hospitality sector by mapping these connections through our marketplace.

In a market network where identity is significant, it becomes possible to capture returns based on incremental marginal utility.

Benefits of a Market Network

In the past decade, we have witnessed the remarkable growth of marketplaces fueled by substantial capital investments. Scaling a two-sided local marketplace—such as Uber, Airbnb, Instacart, and DoorDash—entails significant expenses. The competition to dominate local markets requires hefty marketing budgets to win customer loyalty. As time passes, growth in saturated markets becomes increasingly costly due to dwindling supply and rising customer acquisition costs (CAC). For instance, acquiring a new driver for a ridesharing company in San Francisco reportedly costs around $2,000 now. With widespread familiarity with Lyft and Uber, those who haven't become drivers are unlikely to do so. Consequently, costly referral bonuses and vehicle leasing programs are employed to attract new drivers. Activating drivers in mature markets incurs substantial costs. Ideally, network effects should reduce acquisition costs over time as a market matures.

In a market network, existing relationships facilitate word-of-mouth referrals and organic growth, ultimately lowering CAC. Our experience at Pared demonstrates that many individuals in hospitality maintain connections with fellow professionals. In contrast, Uber drivers and Instacart shoppers often lack prior communal ties. Unlike those marketplaces where casual drivers and shoppers emerge, our professionals have dedicated years to their craft. Network effects flourish when connections exist between nodes within an actual network. Referrals should circulate freely in a market network. At Pared, over 50% of our new users originate organically or through word-of-mouth. Distinguishing between virality and network effects is crucial. Currier succinctly explains: "Virality is about growth; people refer your product to others. Network effect is focused on retention and business defensibility. Once a strong network effect is established, competition becomes exceedingly challenging."

Marketplaces that fail to benefit from network effects that lower CAC over time must rely on raising capital to expand and capture market share while striving for a cost-efficient model with positive unit economics. In ridesharing, escalating acquisition costs and increasing driver turnover in saturated markets necessitate vast capital investments to buy time for the rollout of self-driving cars.

In marketplaces where identity holds little significance, the potential returns are limited. Scenarios exist where surge pricing allows capturing returns based on scarcity and timing. For instance, Lyft drivers earn more during peak traffic times or high-demand events like New Year’s Eve. Instacart can charge a premium for early delivery slots if urgency exists. Yet outside these parameters, avenues for revenue growth are scarce, primarily relying on volume. Without the ability to increase prices, the only option is to boost sales volume.

In a market network, where identity is crucial, capturing returns based on marginal utility becomes feasible. A parent may pay a premium for a sitter on Trusted due to prior positive experiences. We've noticed customers willing to pay more for specific professionals they trust. Conversely, a rider using Uber generally doesn't care about the identity of their driver or delivery person, making them unlikely to pay extra for the option to choose.

Prior experience or interactions can elevate returns, as can specialized skills. Customers on Honor are inclined to pay more for a caregiver with expertise in seizure recognition to care for their elderly loved ones. Similarly, restaurants on Pared are willing to invest more for skilled line cooks with experience in Michelin-starred establishments or sushi chefs. The potential for returns in a market network far surpasses that of most marketplaces. I plan to explore how differentiated supply enhances defensibility in future discussions.

Network Effects

Numerous marketplaces leverage network effects, though not all benefit equally due to the diversity of network effects at play. The timeline for network effects to materialize varies across marketplaces. NYU professor Arun Sundararajan categorizes network effects into five broad types:

- Direct (Same-Side) Network Effects: Increased usage leads to direct value enhancement.

- Indirect (Cross-Side) Network Effects: Increased usage encourages the consumption of complementary goods, enhancing the original product's value.

- Two-Sided Network Effects: Increased usage by one user group adds value for a different group, and vice versa.

- Local Network Effects: Usage increases by a small subset of users elevate value for connected users.

- Compatibility and Standards: Adoption of one technology product fosters the use of compatible products.

For example, Instagram benefits from direct network effects, growing in value as more users join and contribute content. Google experiences indirect network effects as G Suite users enhance the product's value through collaboration. Uber exemplifies two-sided network effects as more riders join, making the platform increasingly valuable to drivers. The more drivers available, the faster rides can be secured, boosting Uber's value for riders (though this effect may plateau). Trusted benefits from local network effects, as caregivers possess specialized skills that offer value to specific parent populations. Lastly, the compatibility and standards effect has propelled companies like Adobe, necessitating the purchase of their software to engage with widely accepted file formats.

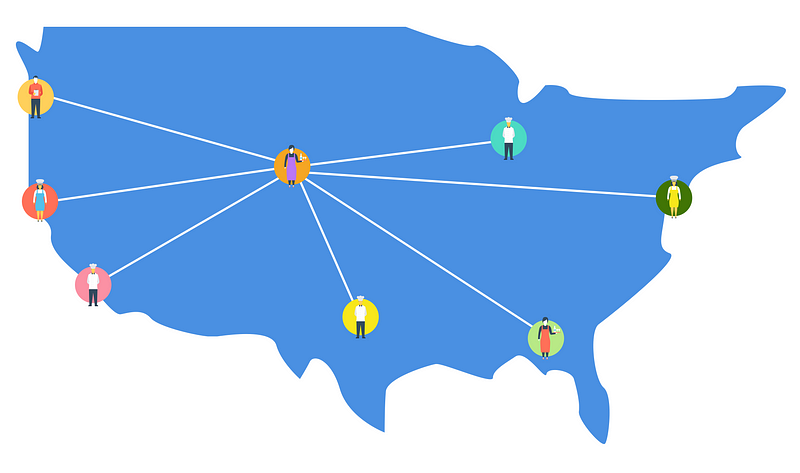

Pared is fortunate to tap into multiple network effects. Indirect network effects arise as we branch into new roles, like bartenders and baristas, which enhance value for both operators and professionals. Two-sided network effects manifest as we expand our restaurant base and geographic reach, attracting a larger talent pool. Local network effects strengthen as we enter new markets; we already observe professionals working across locations, such as San Francisco and New York. Given the restaurant industry's transient nature, supply-side mobility is advantageous. It also appeals to demand-side customers, as many restaurant chains operate in multiple cities. Our partnerships with clients like Proper Food, which has operations in both New York and San Francisco, amplify our network’s strength. Ultimately, if we achieve a reputation for vetting high-quality hospitality professionals and gain sufficient penetration, we aspire to establish ourselves as the industry standard for staffing.

Leveraging Existing Networks

Launching a marketplace from scratch is notoriously challenging. Many entrepreneurs face the "chicken or egg" dilemma. My experience building Luxe, an on-demand valet service, provided firsthand insights into this difficulty. New marketplaces often lack network effects until they reach a critical mass. While serving as VP of Marketing, I launched six new markets in cities including New York, Seattle, Chicago, Austin, Boston, and Philadelphia. I was responsible for acquiring both supply and demand in these emerging markets. The strategies employed varied significantly from city to city. On the supply side, we recruited valets through platforms like Craigslist and Indeed, referral bonuses, and even targeted college campuses. On the demand side, I leveraged various channels, including Facebook and Google ads, referral programs, corporate partnerships, radio spots, podcast ads, and billboards (which proved costly). In our most established market, San Francisco, we enjoyed brand recognition due to our blue jackets and scooters. However, in a sprawling city like Los Angeles, that recognition was lacking. The efficacy of network effects in one market does not guarantee success in another. Thus, building a network without an existing foundation can be daunting and capital-intensive, requiring significant investment to generate supply and demand. Companies like Instacart must target anyone needing groceries or anyone who could shop for them. Uber and Lyft face similar challenges, marketing to everyone in need of rides.

In contrast, Incredible Health—a market network for nurses—benefits from existing professional networks. Targeting nurses is far more efficient than trying to reach anyone needing groceries. Once you engage with a nurse, they can easily share their experience with peers in the healthcare sector.

My prior experience at Luxe equipped me to create a marketplace, but at Pared, I had the advantage of entering an industry rich with existing networks. We confidently venture into new markets, leveraging established relationships within the hospitality sector. This reflects the power of real-world market networks and their effects. Just as Facebook began with the network of Harvard students, Pared commenced with connections among San Francisco restaurateurs. My co-founder Will Pacio has collaborated with some of the world's finest chefs under Thomas Keller at Per Se and The French Laundry. His industry expertise and connections lend credibility and trust, granting Pared access to an exclusive network of restaurateurs. Will's deep community ties include a position on the board of the Golden Gate Restaurant Association. Without validation through referrals and testimonials, we likely wouldn't engage with esteemed restaurant groups like the Crenn Dining Group (e.g., Atelier Crenn, Bar Crenn), Thomas Keller Restaurant Group (e.g., Bouchon Bakery), Jean Georges Group (e.g., Jean Georges, ABC Kitchen), and Major Food Group (e.g., Parm, Dirty French). Each respected restaurant we onboard enhances the desirability and value of our network for both supply and demand. Social proof and reputation attract more skilled professionals and prominent clients. As restaurant groups operate across multiple markets and chefs frequently move, we avoid starting from scratch each time we enter a new location. The compounding effects of cross-side, two-sided, and local networks will continue to fuel growth and defensibility in our business.

Launching a marketplace is challenging, but establishing one without an existing network is even more difficult. Existing networks enable a market network to build upon connections and relationships, quickly harnessing network effects for growth. These effects contribute to increasing lifetime value (LTV) and decreasing customer acquisition costs (CAC), ultimately fostering a healthy business.

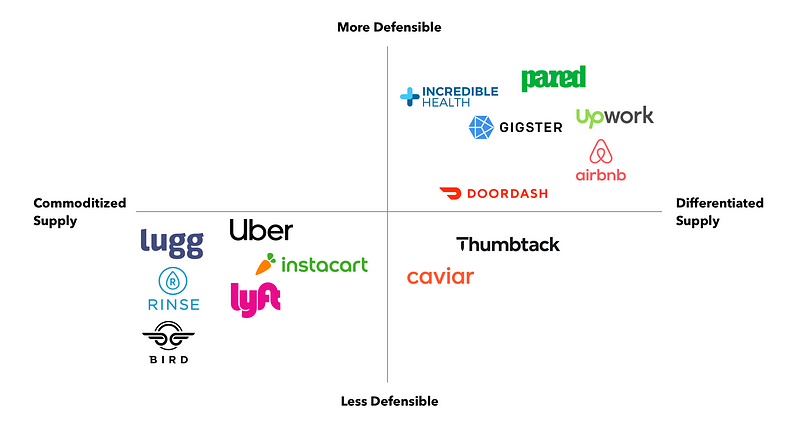

Defensibility of Supply

The most straightforward marketplace model involves a single product or service exchanged between a buyer and a seller. Most marketplaces evolve from selling one type of offering to a diverse array by utilizing technology and platforms to broaden their reach. For example, Amazon began with book sales in 1994 before diversifying into various products by 1998. Uber transitioned from ridesharing to food delivery with Uber Eats and logistics with Uber Freight (after an unsuccessful attempt with Uber Rush). Some marketplaces, like Rinse, Wag, or Handy, maintain a singular focus to excel in one area. A streamlined product offering and marketing message can be advantageous. However, a sole focus can also present low barriers to entry unless the product or service is particularly challenging to replicate.

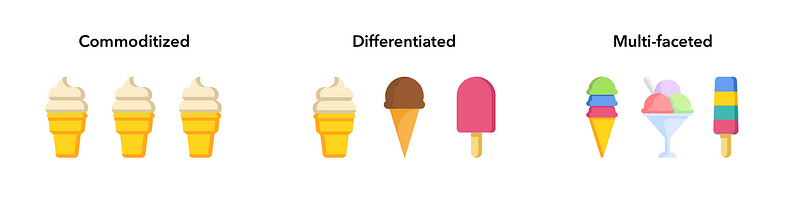

Marketplaces can be categorized into three distinct types based on the nature of their inventory:

- Commoditized: These marketplaces offer interchangeable products or services. Examples include Lyft, Bird, and Instacart, where rides or grocery shopping services are largely indistinguishable.

- Differentiated: These marketplaces provide varied products or services. Airbnb exemplifies this with diverse listings based on size and amenities, impacting demand for different inventory types.

- Multi-Faceted: These marketplaces feature differentiated offerings with multiple dimensions of value. For instance, a service marketplace may have professionals with various skills, enhancing their appeal across multiple customer segments.

Commoditized Marketplaces

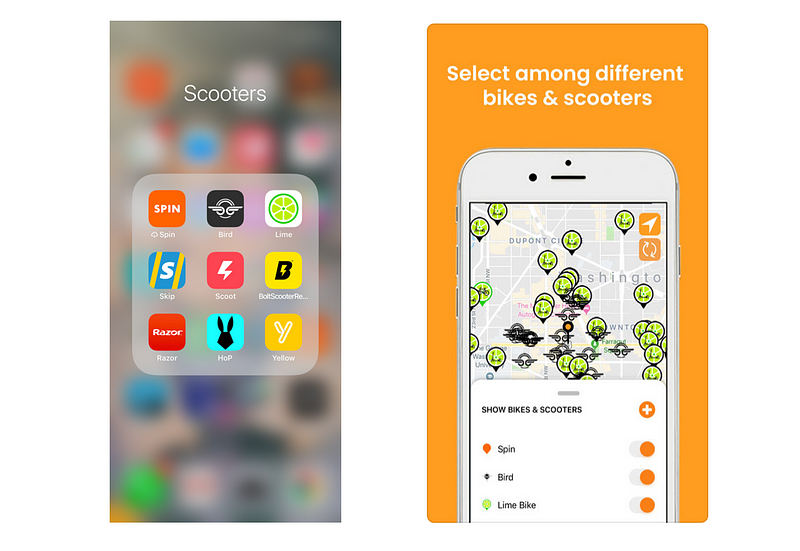

Commoditized marketplaces are quick to launch and grow since they can concentrate on a single offering. Generous capital investments can expedite market dominance and suppress competition. However, this simplicity also invites competition, as seen in the electric scooter market. If one possesses the funds to acquire a fleet of scooters and establish an app for geolocation and payment processing, entering the scooter business becomes feasible. This oversimplification illustrates how numerous scooter companies, such as Bird, Lime, Spin, and Scoot, flooded the market. Consumers often perceive no significant differentiation between scooter providers, leading to indifference. When seeking a ride, users prioritize finding the nearest available scooter, as the choice among brands becomes negligible. The same applies to ridesharing; many riders consider Lyft and Uber interchangeable, focusing on price and convenience.

Commoditized marketplaces are among the least defensible until achieving market dominance, which is why they often require substantial funding. Reid Hoffman and Chris Yeh refer to this as the "first-scaler advantage" in their book Blitzscaling: The Lightning-Fast Path to Building Massively Valuable Companies, stating, "The most frequent offensive reason for blitzscaling is to achieve a critical mass that confers a lasting competitive advantage." However, even after attaining market dominance, competitors and newcomers can threaten market share, as demonstrated by Lyft's encroachment on Uber's territory in San Francisco. Without customer loyalty or substantial switching costs, users can easily transition to alternatives.

Differentiated Marketplaces

Differentiated marketplaces cater to varied customer needs through diverse product offerings. Zappos, for instance, is a differentiated marketplace as it sells various shoe types. Delivery platforms like Caviar, Uber Eats, and DoorDash also feature broad restaurant selections, attracting customers based on available options. Although they provide similar services, exclusivity agreements with restaurants differentiate them. Likewise, Airbnb, VRBO, and HomeAway offer unique vacation rental options, distinguishing themselves through their inventories.

Differentiation is potent; the stickier a platform becomes for customers, the less likely they are to leave. When users engage with multiple products, they are less inclined to churn. This principle was evident at Yahoo!, where research indicated that users engaged with three Yahoo! products were likely to remain active users. Diversifying product offerings enhances engagement and mitigates churn risks.

Multi-faceted Marketplaces

Multi-faceted marketplaces present differentiated inventory with various dimensions of value. For example, Storefront rents out physical spaces for various purposes, while service marketplaces may showcase professionals with diverse skills. Unlike ridesharing platforms, which require a single skill, Upwork features freelancers with varied capabilities, from programming to language proficiency. On Pared, skilled line cooks can also perform roles like prep cook, dishwasher, or busser, given their prior experience.

The restaurant labor force is inherently diverse, encompassing specialized skills like pastry-making, oyster shucking, and sushi preparation. A sushi restaurant may pay a premium for a sushi chef due to scarcity. Li Jin and Darcy Coolican from a16z emphasize the strength of differentiation: "Platforms/marketplaces with more differentiated inventory have stronger and longer-lasting network effects, as they cater to unique customer preferences while maintaining sufficient substitutability." The more specialized chefs added to the supply pool, the greater the marketplace's value. Effective curation and matching play vital roles in supporting differentiated supply.

The difficulty of curation and matching significantly impacts marketplace success. Failing to meet demand with quality supply leads to customer churn. Pared often receives inquiries about expanding into other sectors beyond hospitality. However, the nuances within hospitality alone pose enough challenges, not to mention the industry’s vast total addressable market (TAM). Attempting to cater to everyone risks diluting focus and effectiveness. TaskRabbit serves as a cautionary tale of a marketplace that struggled with identity. Originally named RunMyErrand.com, TaskRabbit faced challenges due to its broad scope, leading to its acquisition by IKEA after raising $38 million to reach a $120 million valuation.

The first-scaler advantage is vital for commoditized marketplaces like ridesharing and scooters. However, it doesn't guarantee immunity from competitors. In differentiated marketplaces, exclusive partnerships can lock in customers, but once those agreements expire, attrition may occur. If a preferred restaurant is no longer available on a platform, customers may switch providers, as seen with food delivery services. This highlights the risk of customer loyalty to brands rather than the marketplace itself.

Successfully building a marketplace atop an existing professional network yields long-term benefits, including lower acquisition costs, increased transaction frequency, and reduced churn.

Repeat Interactions and Reputation

In commoditized marketplaces like Uber or Lyft, the likelihood of being matched with the same driver is slim—especially in larger markets. Negative reviews from riders do not necessarily restrict opportunities until ratings fall below a certain threshold. Commoditized marketplaces often foster one-time interactions between supply and demand. In contrast, repeat interactions with service providers are prevalent in platforms where reputation, identity, or brand matter; customers seek consistently high-quality experiences.

The terms "repeat transactions" or "repeat interactions" in this context refer to multiple engagements with specific service providers rather than merely multiple transactions with the marketplace. In market networks, where repeat transactions are common, service providers are incentivized to perform well, as poor performance results in fewer opportunities and diminished earnings. A nurse working on Incredible Health cannot afford to underperform, given the limited number of hospitals offering work. Market networks hold supply accountable, as their reputation and identity matter to all network participants. Freelancers on Upwork rely on their reputations to secure future contracts, motivating them to maintain high ratings.

Repeat transactions, new connections, and interactions enhance network value over time. For companies like HoneyBook, which target wedding planning, repeat interactions are infrequent. Similarly, Thumbtack builds identities and reputations on its platform, though the demand for certain services is limited. In contrast, Trusted connects parents with childcare professionals, emphasizing the importance of relationships and reputation through repeat transactions. For a market network to thrive, participants must derive value from their connections. Frequent interactions and relationships are particularly challenging to establish outside sectors with existing networks that remain unformulated.

When reputation plays a crucial role on a platform—dictating opportunities through repeat transactions, as seen with Upwork, Trusted, or Pared—there is a level of stickiness absent in commoditized marketplaces. How many drivers do you see with both Lyft and Uber stickers? Many drivers switch between the two platforms to maximize earnings and transaction volumes. Both platforms operate on simple rating scales; a driver can offset a negative review with positive experiences. In contrast, a Pro on Pared who receives a poor rating for a job may find it challenging to secure future offers from that establishment, limiting their earning potential. Conversely, as a Pro builds a positive reputation on the platform, more opportunities arise as they acquire new skills. The switching costs for them to rebuild their reputation on a different platform become substantial. Every positive testimonial from a network node—be it a restaurant operator or another Pro—enhances their standing. Conversely, a rider's identity holds little importance when it comes to rating.

The primary challenge for any skills-based marketplace is ensuring quality. A marketplace's value diminishes if supply cannot fulfill necessary tasks. Skills verification is invaluable for marketplaces. This can involve interviews, work history checks, or assessments to validate capabilities. Meeting candidates in person and conducting interviews or auditions effectively determine their qualifications. Verifying work history through references also confirms a candidate's competence. Certifications, such as those required for medical professionals or lawyers, filter quality to some extent. While these exams do not guarantee excellence, they establish a baseline of knowledge and expertise. For instance, Gigster, a professional marketplace connecting tech firms with freelance programmers, thoroughly vets candidates through various screenings. Customers are willing to pay a premium for this rigorous vetting process, ensuring peace of mind.

Although subscription and SaaS models experience lower churn rates than many marketplaces, repeat transactions can substantially enhance retention. When customers trust and wish to collaborate with a service provider repeatedly, this loyalty can be cultivated. By fostering features that enhance service provider satisfaction on the platform, customer loyalty can similarly be maintained. Thus, it is critical to prioritize supply satisfaction in any marketplace, as their departure often leads to customer loss. Conversely, if high-quality supply can be curated and demonstrated to customers, business can be salvaged. Consistently delivering excellent matches and exceptional customer experiences is the only way to achieve this. A commoditized marketplace's one-off transactions mean customers are less likely to churn if any individual service provider departs. For example, a customer may not stop using Lyft if a driver they previously used is no longer active, as they likely remain unaware. However, if a favored stylist leaves StyleSeat, the customer will likely leave as well unless they have had excellent experiences with other stylists on that platform.

The greatest threat to repeat transactions and reputation in a market network is disintermediation. If a customer discovers a highly-rated service provider and consistently works with them, it is natural to consider hiring them directly outside the platform. This phenomenon contributed to the decline of home-cleaning marketplaces like Homejoy. Disintermediation creates leaks in both supply and demand. To mitigate this, a platform must be compelling and retain both parties. Professionals often prefer the flexibility and higher wages offered by Pared, while operators consistently grapple with turnover and recruitment challenges. Trust and convenience are essential for retention. Jonathan Golden, now a partner at NEA, highlights the importance of these factors in his article "Four Questions Every Marketplace Startup Should Be Able to Answer."

Building a company is akin to assembling a Cessna. Building a marketplace resembles constructing a Boeing 747.

Conclusion

Numerous academics have researched and authored papers on network effects and marketplaces, far surpassing my knowledge. My insights stem from personal experiences in building marketplaces and lessons learned from brilliant colleagues in the field. Reid Hoffman likens launching a startup to leaping off a cliff while assembling an aircraft during the descent. I've learned that every marketplace possesses unique nuances and challenges (including legislation, geography, and unions). Anyone contemplating a marketplace venture should understand the different types of marketplaces and potential network effects they might leverage. Those already immersed in building a marketplace or market network should focus on creating products and features that enhance and accelerate the network effects that will drive their success.