Where Might the S&P 500 Finish by Year-End? Insights and Analysis

Written on

Market Predictions in Uncertain Times

As the majority of market indices dip into negative territory, forecasting the S&P 500's year-end position becomes increasingly complex. Is a positive finish possible? How can we systematically tackle such a question?

Photo by Virgil Cayasa on Unsplash

With growing concerns about a potential recession fueled by rising energy and food costs, the narrowing spreads between 10-year and 2-year treasury bonds indicate troubling signs. Amid these uncertainties, how can we make educated guesses about the market's trajectory for the year-end? This article aims to demystify the process of predicting market returns annually.

Investment banks in both the US and Europe typically release their price targets for the S&P 500 for the upcoming year at the close of each calendar year. But how do they arrive at these figures? Do they rely on chance, or do they utilize sophisticated models to forecast every stock's price?

Understanding S&P 500 Returns

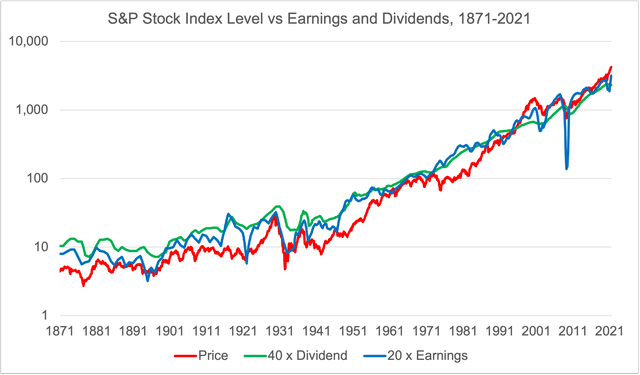

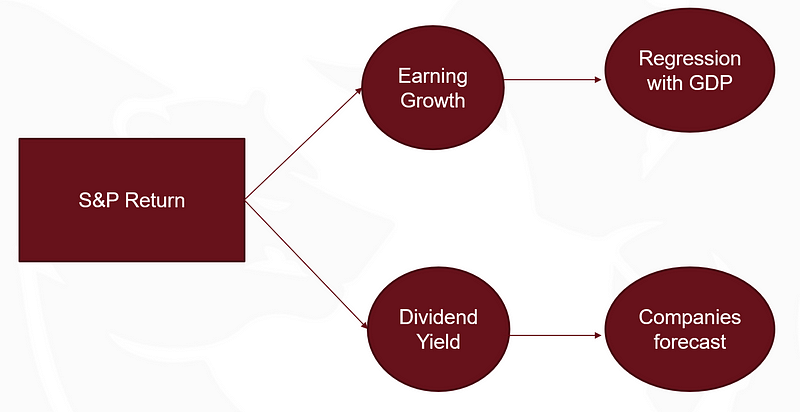

To comprehend where the S&P 500 may land by the year's end, we must first explore the sources of its returns. Historical data reveals that over the past century, 95% of the market's performance can be attributed to earnings growth and dividend yield. These two factors serve as the most reliable indicators of the index's year-end outcomes.

The chart below illustrates the relationship between the index, earnings, and dividends.

To determine the S&P's year-end position, we need to assess projected dividend yields alongside anticipated earnings growth.

Earnings Growth and Dividend Yield Explained

Earnings Growth

Earnings growth can be forecasted using various economic indicators. Analysts often consider factors like GDP, household income, and unemployment rates to inform their models. However, as with any predictive model, inaccuracies can arise.

Dividend Yield

The dividend yield for the S&P 500 is typically gauged through guidance provided by its constituent companies. Many firms do not distribute dividends, while those that do tend to offer forecasts for their expected yields in the upcoming year.

The Big Question: S&P Return for 2022

Despite facing numerous challenges—from geopolitical tensions to economic downturns—many companies continue to report positive earnings. The median earnings growth predicted by major investment banks for the S&P stands at 5% to 7% for the upcoming year, while the expected dividend yield is around 0.87%.

When we combine these components, the anticipated market return for 2022 likely falls between 6% and 8%.

For those eager to delve deeper into market forecasting and investment strategies, consider checking out my best-selling book on Amazon.

Stock Market Explained: A Beginner's Guide to Investing and Trading in the Modern Stock Market…

Amazon.com: Stock Market Explained: A Beginner's Guide to Investing and Trading in the Modern Stock Market (Personal…

www.amazon.com

Conclusion: Optimism Amidst Challenges

Even as we navigate a market correction and contend with recession fears and soaring energy prices, I remain optimistic about the potential for a modest return of 5% to 7% by year-end. Recent job reports indicate a robust US consumer base, with many experiencing increases in disposable income. While the first half of the year may present challenges, I anticipate clearer insights as we progress into the latter part.

What are your thoughts? Feel free to share your insights in response to this article.

A Small Request

I hope this article has been beneficial to your investment journey. Don't hesitate to explore more of my work or connect with me for updates.

- Follow me on Medium!

- Explore my books on Amazon!

- Join me on LinkedIn!

- Subscribe to my YouTube channel for daily market updates!

- Connect on Twitter!

- Schedule a DDIChat Session in Financial Markets and Analysis:

Experts - Financial Markets and Analysis - DDIChat

DDIChat allows individuals and businesses to speak directly with subject matter experts. It makes consultation fast…

app.ddichat.com

Apply to be a DDIChat Expert here.

Subscribe to DDIntel here.

In this insightful video, learn the nuances of using apostrophes correctly in English grammar.

This video provides a comprehensive guide on using the auxiliary verb 'would' in various contexts.