Harnessing the OVB X Indicator for Effective Trading Strategies

Written on

Chapter 1: Introduction to the OVB X Indicator

In the constantly changing world of financial markets, traders must utilize a range of tools and indicators to gain a competitive advantage. The OVB X Indicator, which is an upgraded version of the traditional On-Balance Volume (OBV) indicator, has been increasingly popular among traders in recent times.

In this detailed guide, we will explore the OVB X Indicator, its background, how it functions, and the ways in which traders can leverage it to make well-informed trading choices.

Chapter 2: The Evolution of OVB X

The On-Balance Volume (OBV) indicator was created by Joseph Granville in the 1960s and has become a staple for technical analysts. The fundamental principle behind OBV is quite simple: it utilizes trading volume to forecast price movements. When trading volume is greater on days when prices rise compared to those when they fall, it indicates stock accumulation; conversely, the opposite suggests distribution. OBV aids traders in confirming trends, spotting potential reversals, and evaluating trend strength.

OVB X represents a contemporary upgrade to the classic OBV indicator. The “X” denotes the incorporation of modern technology and diverse data sources, enhancing its functionality for today’s traders.

OVB X boasts enhanced precision, real-time data integration, customizable features, advanced algorithms, and an intuitive interface.

Section 2.1: Understanding OVB X

To maximize the effectiveness of OVB X, it is crucial to comprehend its operational mechanics. The key features of OVB X include:

- Real-time Data Integration: OVB X connects to live market data, ensuring traders access the most current information. This real-time capability is invaluable in fast-moving markets.

- Customizability: The indicator can be modified to suit individual traders' needs, making it adaptable across various trading strategies and asset classes.

- Advanced Algorithms: OVB X uses sophisticated algorithms to detect anomalies in volume and price fluctuations, aiding traders in identifying potential trend reversals and shifts.

- User-Friendly Interface: Often integrated into popular trading platforms, OVB X is easy to use, allowing traders to incorporate it into their technical analysis seamlessly.

Chapter 3: Practical Applications of OVB X

Here's how traders can effectively apply the OVB X Indicator:

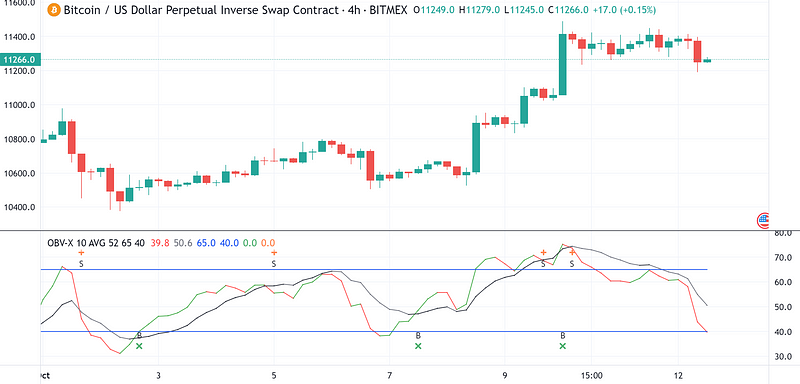

- Trend Confirmation: A primary use of OVB X is to affirm existing trends. If the OVB X line aligns with the asset’s price movement, it signals strong trend confirmation. For example, if a stock is on an upward trajectory and the OVB X line is also climbing, this strengthens the bullish outlook.

- Divergence Recognition: Observing divergence between the OVB X line and the asset price can indicate potential reversals. For instance, if a stock reaches new highs while the OVB X line does not reflect this, it could suggest diminishing buying pressure.

- Accumulation and Distribution Assessment: OVB X can help traders discern whether an asset is accumulating or distributing. A consistently rising OVB X line while the price remains stable may indicate accumulation, while a falling OVB X line could signal distribution.

- Risk Management: Traders can utilize OVB X for effective risk management. If the OVB X line confirms a trend but begins to diverge, it may be a warning to tighten stop-loss orders or close positions to protect against potential reversals.

- Combining with Other Indicators: OVB X is most beneficial when used alongside other technical indicators, such as moving averages or the Relative Strength Index (RSI). This combination can provide a more comprehensive view of market dynamics and reduce the likelihood of false signals.

The OVB X Indicator stands as a powerful evolution of the classic On-Balance Volume indicator, integrating modern technological advancements for greater accuracy and real-time data integration. When leveraged properly, OVB X can provide traders with critical insights into market dynamics, aiding them in making informed decisions. However, it’s vital to remember that no single indicator guarantees trading success. A holistic approach, combining OVB X with other tools, robust risk management practices, and thorough market analysis, is essential for traders aiming to succeed in today’s dynamic financial landscape.

Chapter 4: Recommended Video Resources

To enhance your understanding of trading strategies, consider watching the following videos:

This video titled "Best Trading Strategies I Have Used EVER (Tier List Edition)" outlines various effective trading strategies based on personal experiences.

The video "99% Of Traders Don't Know About This Secret Tool ( Tested 100 Times )" reveals a lesser-known tool that can significantly impact trading decisions.